Navigating UK Mortgage Options: A Comprehensive Guide for Expats

As an expatriate, investing in UK property, whether for personal residence or as an investment, presents a unique set of opportunities and challenges. Understanding the specific mortgage options available and the criteria lenders use is paramount to a successful application. This guide provides a detailed overview of UK mortgage solutions tailored for expats, ensuring a professional and informed approach to property acquisition.

Understanding Expat Mortgage Dynamics

Expats are individuals residing outside their country of citizenship. For UK mortgage purposes, this typically refers to British citizens living abroad or foreign nationals living outside the UK but seeking to purchase property within the UK. The primary distinction for lenders lies in assessing income, residency status, and credit history, which often require specialized approaches.

Challenges Faced by Expat Borrowers

Expats often encounter hurdles such as:

Income Verification: Proving stable income from an overseas employer, especially in a foreign currency, can be complex.

Credit History: A lack of a recent UK credit footprint can make traditional lenders hesitant.

Residency and Tax Status: Determining tax implications and residency status for mortgage qualification.

Time Differences and Logistics: Coordinating applications from different time zones.

Types of UK Mortgages Available for Expats

While the core mortgage products remain similar to those offered to UK residents, the eligibility criteria and lender appetite differ significantly.

1. Residential Mortgages for Expats

These mortgages are for expats looking to purchase a property in the UK for their personal use, either immediately or upon their return. Lenders offering these products will scrutinize the applicant’s intent, the property’s potential occupancy, and their overall financial stability.

- Eligibility: Often requires a larger deposit (e.g., 25% or more), a demonstrable link to the UK, and robust proof of stable overseas income. Some lenders may prefer income in a ‘major’ currency (USD, EUR, CHF) or require a minimum income threshold.

- Lenders: A growing number of mainstream and specialist lenders cater to expat residential mortgages, though criteria vary widely.

2. Buy-to-Let (BTL) Mortgages for Expats

Expat Buy-to-Let mortgages are a popular option for those seeking to invest in the UK property market, renting out the property to tenants. Lenders primarily assess the rental income potential of the property, alongside the applicant’s personal income.

- Eligibility: While rental income is key, lenders still require evidence of personal income to cover any potential voids or unexpected costs. Loan-to-value (LTV) ratios might be stricter than for UK resident BTL applicants. Many lenders will require the applicant to own at least one other property already, whether in the UK or overseas.

- Advantages: Can be a simpler route for expats as the primary assessment often focuses on the property’s income-generating potential, rather than solely on overseas earned income.

3. Specialist Expat Mortgage Lenders

A niche market of specialist lenders and brokers specifically caters to expat needs. These providers often have a deeper understanding of international income structures, foreign credit reports, and the unique circumstances of expat life.

- Flexibility: They may offer more flexible criteria regarding income currency, employment types, and residency periods.

- Broker Expertise: Engaging with a mortgage broker specializing in expat finance can significantly streamline the process and open doors to lenders not accessible on the high street.

Key Factors Influencing Expat Mortgage Applications

Successfully securing a UK mortgage as an expat hinges on presenting a clear and comprehensive financial picture.

Income and Employment

Lenders will assess the stability and source of your income. They typically look for:

Stable Employment: A minimum employment history (e.g., 6-12 months) with a reputable employer.

Currency: While income in major currencies (USD, EUR) is generally accepted, some lenders may apply a ‘haircut’ to account for currency fluctuations. Income in more volatile currencies might be harder to place.

* Proof of Income: Payslips, employment contracts, and bank statements are crucial. For self-employed expats, typically 2-3 years of audited accounts are required.

Deposit Requirements

Expats often face higher deposit requirements compared to UK residents. A minimum of 20-25% is common for residential mortgages, and 25-30% for Buy-to-Let. A larger deposit can improve your chances and potentially secure better rates.

Credit History

Establishing a UK credit footprint can be challenging. Lenders may consider:

International Credit Reports: Some specialist lenders may review credit reports from your country of residence.

UK Bank Account History: A well-maintained UK bank account with regular activity can help.

* Utility Bills/Council Tax: Evidence of previous UK addresses with utility payments can also be beneficial.

Documentation Required

Be prepared to provide extensive documentation, which typically includes:

Proof of identity (passport).

Proof of current address (utility bills, bank statements).

Proof of income (payslips, employment contracts, bank statements).

Bank statements showing savings for the deposit.

Proof of existing assets and liabilities.

Details of your UK property interest (if any).

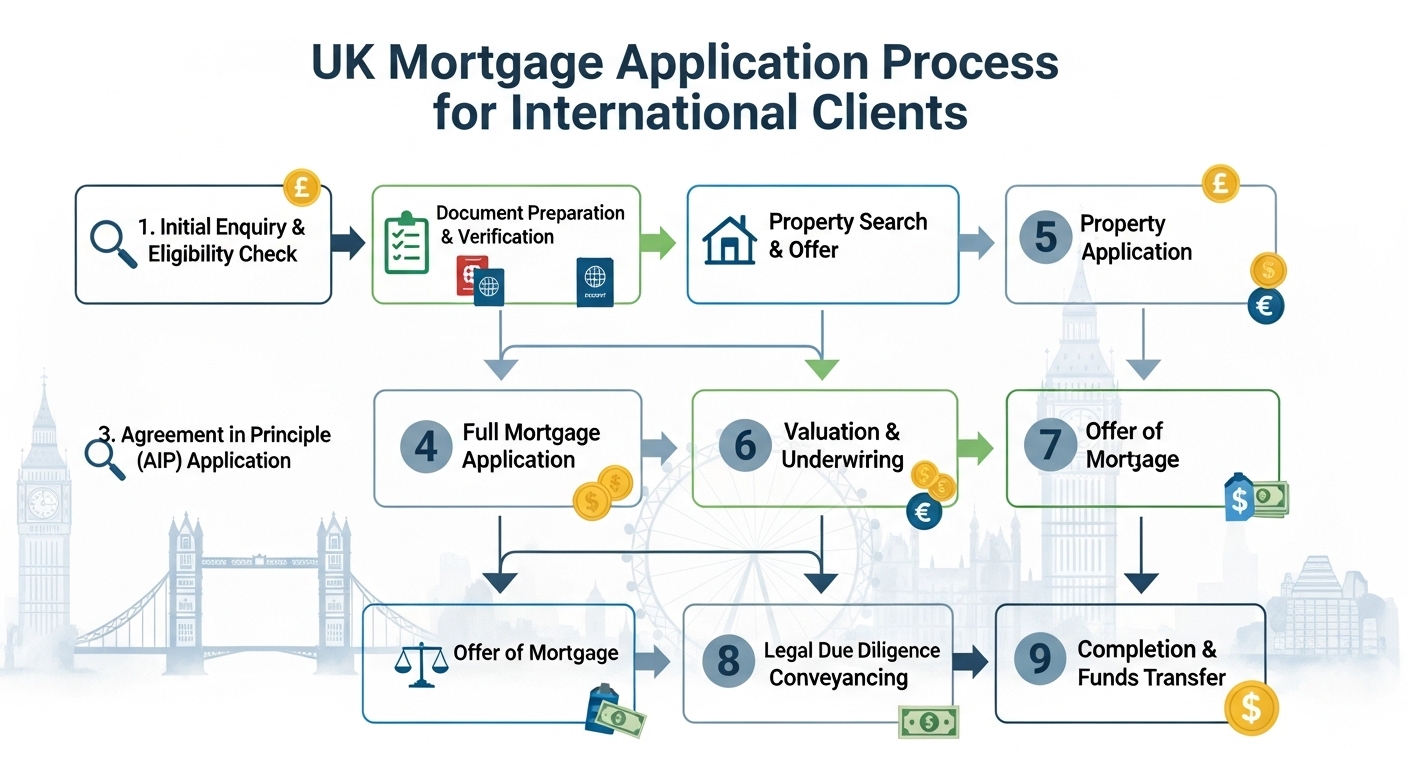

The Application Process for Expats

- Seek Expert Advice: Engage with a mortgage broker specializing in expat mortgages.

- Gather Documentation: Prepare all necessary financial and personal documents.

- Agreement in Principle (AIP): Obtain an AIP to understand your borrowing capacity.

- Property Search and Offer: Find a suitable property and have your offer accepted.

- Full Application: Submit a comprehensive application with all supporting documents.

- Valuation and Underwriting: The lender will value the property and assess your application.

- Mortgage Offer: Receive and review the formal mortgage offer.

- Legal Work and Completion: Solicitors handle conveyancing, and funds are released upon completion.

Conclusion

While securing a UK mortgage as an expat requires diligent preparation and an understanding of specific lending criteria, it is an entirely achievable goal. By understanding the various mortgage options, preparing thorough documentation, and leveraging the expertise of specialist brokers, expats can successfully navigate the UK property market. A proactive and informed approach will pave the way for a smooth and efficient property acquisition experience.