Navigating UK Business Banking: Top Accounts for Expats

Starting or managing a business in the UK as an expat can present unique challenges, especially when it comes to banking. Accessing suitable business bank accounts is crucial for managing finances, processing payments, and ensuring compliance. This article explores some of the best UK business bank account options tailored to the needs of international entrepreneurs and expatriates.

The Unique Banking Landscape for Expats

Expats often face hurdles such as stringent proof of address requirements, lack of a UK credit history, and complexities with international transactions. Traditional banks may have stricter eligibility criteria, making it difficult for non-residents or those new to the UK to open accounts swiftly. Fortunately, modern banking solutions have emerged to address these specific needs.

Key Features to Prioritize

When selecting a UK business bank account as an expat, consider the following features:

- Ease of Opening: Can the account be opened online without a UK address, or with flexible proof of ID?

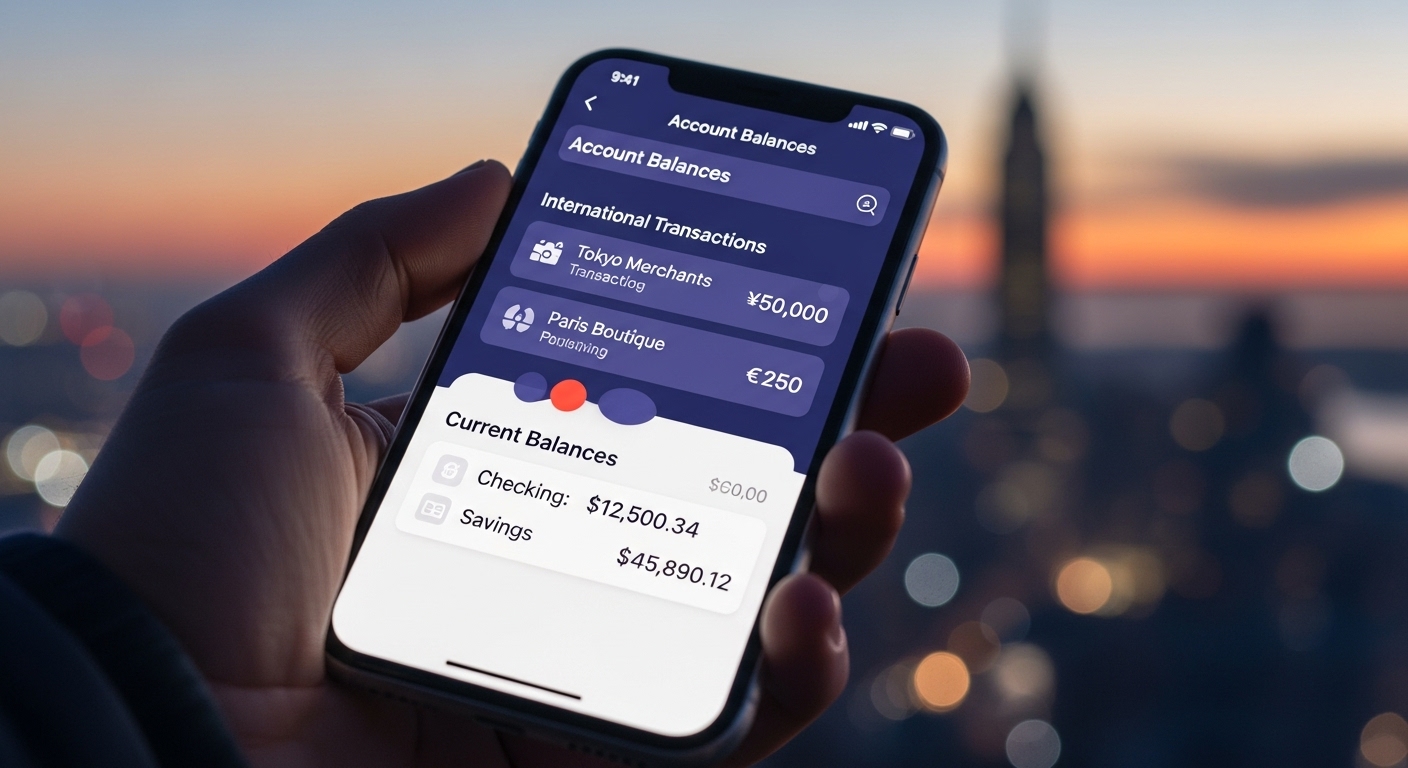

- International Payments: Low-cost, efficient international transfers and multi-currency capabilities.

- Online and Mobile Banking: Robust digital platforms for managing finances remotely.

- Fees and Charges: Transparent fee structures, especially for international transactions and account maintenance.

- Customer Support: Accessible and helpful support, ideally with international language options.

Leading UK Business Bank Account Options for Expats

Several financial institutions in the UK are particularly well-suited for expat business owners, ranging from agile challenger banks to digitally-focused traditional options.

1. Wise Business

Wise (formerly TransferWise) is renowned for its international money transfer services, and its business account extends this expertise. It allows businesses to hold and manage money in over 50 currencies, receive payments like a local in 10 currencies (including GBP, EUR, USD), and send money at the real exchange rate with low fees. Opening an account is often straightforward, with online verification processes making it accessible for expats.

- Pros: Excellent for international transactions, multi-currency support, transparent fees, easy online setup.

- Cons: Not a full-service bank (no lending products), primarily online-only.

2. Revolut Business

Revolut Business offers a comprehensive suite of tools designed for modern businesses, with a strong emphasis on international operations. It provides multi-currency accounts, international payments, expense management, and integration with accounting software. Their onboarding process is largely digital, appealing to expats seeking efficiency.

- Pros: Multi-currency accounts, budgeting tools, virtual cards, API integrations, often quicker setup.

- Cons: Some premium features require paid plans, customer service is primarily app-based.

3. Starling Bank Business

Starling Bank is a UK-licensed challenger bank that offers a highly-rated business account with no monthly fees for its basic service. While it technically requires a UK address for opening, their digital-first approach and robust features, including spending insights, invoicing tools, and integration with Xero/FreeAgent, make it an attractive option for expats who have established a UK residence. They offer excellent customer service and fee-free ATM withdrawals in the UK and abroad.

- Pros: No monthly fees for basic account, excellent app, 24/7 UK-based customer support, strong integrations.

- Cons: Requires a UK address for account opening, less focus on multi-currency holding compared to Wise.

4. HSBC Kinetic

HSBC Kinetic is a digital-only business account from a traditional banking giant, designed for small businesses and start-ups. While it’s part of a large bank, Kinetic offers a more streamlined, app-based experience. It provides quick setup (often within minutes), spending insights, cash flow forecasts, and access to HSBC’s broader network for international transfers. As a major bank, it can offer a sense of security and potentially easier access to other financial products in the future, though eligibility for expats might still be stricter than challenger banks.

- Pros: Backed by a major global bank, fast digital setup, spending insights, potential for broader financial services.

- Cons: Eligibility might be stricter for new expats without a clear UK footprint, potentially higher fees for some services.

Important Considerations Before Opening

- Documentation: Always prepare necessary documentation like passport/ID, proof of business registration, and details of your UK residence (if applicable).

- Fees: Carefully compare monthly fees, transaction charges, international transfer costs, and ATM withdrawal fees.

- Customer Support: Ensure the bank offers support channels that suit your preference and can assist with international queries.

- Integration: Consider if the bank integrates with your existing accounting software or other business tools.

Choosing the right UK business bank account as an expat requires careful evaluation of your specific business needs and personal circumstances. By prioritizing ease of access, international capabilities, and transparent fee structures, you can find a solution that supports your entrepreneurial journey in the UK.